I have recently completed a regulatory project for a large financial institution where all over-the-counter transactions (OTC) related to REPO, Reverse REPO, and Debt Securities (CIRO 7200) conducted by dealer members have to be reported to the Canadian regulator, i.e., CIRO.

This mandate was largely done so that the central bank:

a) ensures there is no market abuse by market participants

b) uses this data to calculate the OIS (overnight indexed swap rates) rate, i.e., CORRA for CAD.

This article aims to define a Repo in a layman’s term, as I found it was an uphill task for a lot of folks in the IT space to understand it by reading it online as most articles are not written for an amateur audience .

- What is a Repo ?

- Who does a Repo and Why?

- How is a Repo Done?

- Different Kinds of Repos?

- Volume of Repos Transaction in Major Financial Markets ?

What is a Repo?

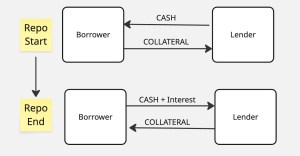

A Repo is a transaction between two parties: borrower(who provides collateral) and the lender(who provides cash), both of these parties are large institutions.

In this transaction a borrower borrows money from the lender against a collateral. Unlike other secured lending transactions, in a repo transaction the lender has legal rights over the collateral supplied during the term of the repo including the right to sell the security, for example, to cover short sell etc. The collateral has to be returned to the borrower by the lender at the maturity of the repo.

The collateral in most repos consists of high-quality bonds, but can be anything else as agreed between the borrower and lender.

Who does a Repo and Why?

A Repo transaction is done largely between large institutions or routed through dealer members assigned by central Banks.

Most of the large Banking and Financial Institutions are registered dealers members. In a real world scenario a hedge fund or insurance company or a corporate entity may need cash to finance their short term needs or a Large Pension Fund need to deploy their excess cash for short term secured lending. To fulfil these needs they do a repo transaction or borrow/lend money against collateral.

In today’s time Repo plays a very important role in Financial Markets by providing liquidity and it also removes over reliance on the commercial banks to provide short term liquidity and hence offers opportunity for the mitigation of credit risk. Here Money savers deploy or lend their excess cash to borrowers at near risk free way due to high quality of collaterals and improved risk management. Also the borrowers are able to borrow money at cheaper rates.

How is a Repo Done?

All repo transaction are still done over the counter (OTC) markets and not traded on an exchange like a stock or a bond. Here the parties negotiate the contracts over the phone followed by a written contract once terms are finalized.

A lot of institutional platforms have emerged, known as Alternative trading system(ATS), which act as market makers by disseminating bid/ask rates by collecting them from borrowers/lenders and matching them but they still qualify as OTC trades.

Types of Repos?

Most repo trades are short term in nature ranging from overnight term to a few days.

There are some other categories of repos which offer more features like an

1) Extendable repos which allows to continuously renew the maturity date on a mutual agreement basis

2) Evergreen repos which allows automatic rollover after each maturity date until it is cancelled by either party

Repo Market Volumes by Region in Major Financial Markets ?

I will cover this in the next article by exploring the repo market volume across major countries, like the US, UK and Europe including Canada.

Reference:

https://www.bankofcanada.ca/wp-content/uploads/2024/10/overview-canadian-repo-market.pdf

https://www.icmagroup.org/market-practice-and-regulatory-policy/repo-and-collateral-markets/icma-ercc-publications/icma-ercc-guide-to-best-practice-in-the-european-repo-market/

Leave a comment